Ed McLaughlin was at Money2020 and explained the future of NFC across smartphones and other devices.

At the Las Vegas 2013 Money2020 event, Ed McLaughlin, the chief emerging payments officer at MasterCard addressed the fact that in mobile payments, “a smartphone is a device, not the only device.”

He explained that transactions may be headed toward the use of smartphones, but not exclusively.

McLaughlin stated that although mobile payments are important in terms of the use of smartphones, the true focus is about building a digital network. Within the demonstrations that were made of the MasterCard technology, a smartphone was used, but so was a watch and a credit card, for example. In fact, it was mentioned that the service has already been effectively tested with Google Glass augmented reality glasses, though they did not have any specific announcement about plans for that device.

McLaughlin stated that although mobile payments are important in terms of the use of smartphones, the true focus is about building a digital network. Within the demonstrations that were made of the MasterCard technology, a smartphone was used, but so was a watch and a credit card, for example. In fact, it was mentioned that the service has already been effectively tested with Google Glass augmented reality glasses, though they did not have any specific announcement about plans for that device.

When a customer has used mobile payments two or three times, tapping the device to pay will be a habit.

MasterCard feels that by the time the customer experiences the convenience of NFC technology for mobile payments, and taps the device or card 2 or 3 times to make a purchase, he or she won’t return to using traditional credit cards. McLaughlin referred to a report that he had just received from Australia, where Kohls has experienced a growth in contactless payments of 60 percent.

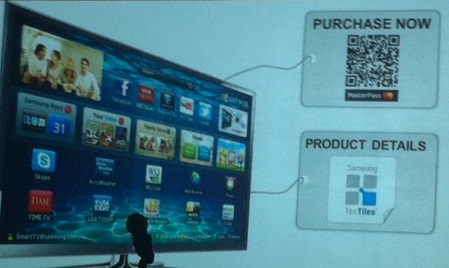

The MasterCard platform uses both NFC technology and QR codes, and it offers a number of app functions and choices to provide a safe and customized experience for the user at the point of sale. This includes additional benefits such as loyalty cards and coupons. The app also provides an interesting feature that allows for a shipping option after an item has been purchased in store. This means that, for instance, if a large TV has been bought, the consumer can opt to have it shipped to their home, instead of having to transport it, themselves.

The MasterCard platform uses both NFC technology and QR codes, and it offers a number of app functions and choices to provide a safe and customized experience for the user at the point of sale. This includes additional benefits such as loyalty cards and coupons. The app also provides an interesting feature that allows for a shipping option after an item has been purchased in store. This means that, for instance, if a large TV has been bought, the consumer can opt to have it shipped to their home, instead of having to transport it, themselves.

This has all been worked into the popular existing PayPass platform from MasterCard, with its tap and go NFC technology feature. It is now being combined with QR codes for added security and to allow the process to remain convenient for consumers who are becoming quite familiar with the barcode scans.

PayPal made a similar mobile payments announcement at Money2020 in which they state that they would also be integrating QR codes into their transaction process to keep security high and yet still convenient.

Retailer to expand availability of mobile payments app

Retailer to expand availability of mobile payments app